DEBT NAVIGATOR

Loan management platform that helps to think another way about the mortgage and get financially free faster

AUCKLAND, NZ | 2021

BACKGROUND

New Zealand Home Loans (NZHL) helps New Zealanders to manage their mortgage loans. Over the last 25 years, the business grew into a nationwide network, saving its clients billions of dollars.

NZHL suggested that their user experience was a bit behind the times. They were operating on legacy platforms and missing opportunities in streamlining processes and automation.

MY ROLE

I was a part of the research & discovery team and led the product design. I was also responsible for the production-ready design hand over to the delivery partner.

SOLUTION

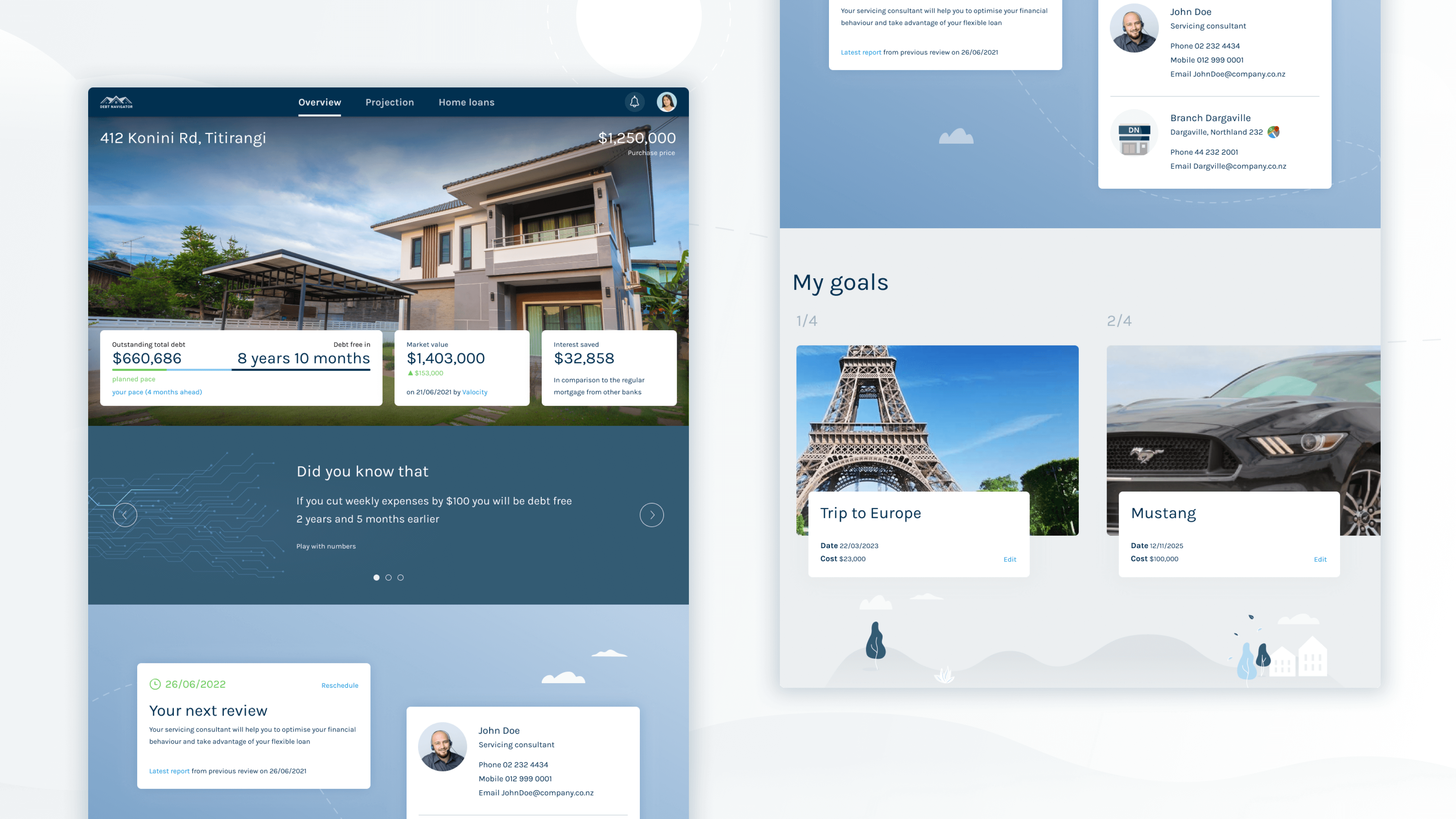

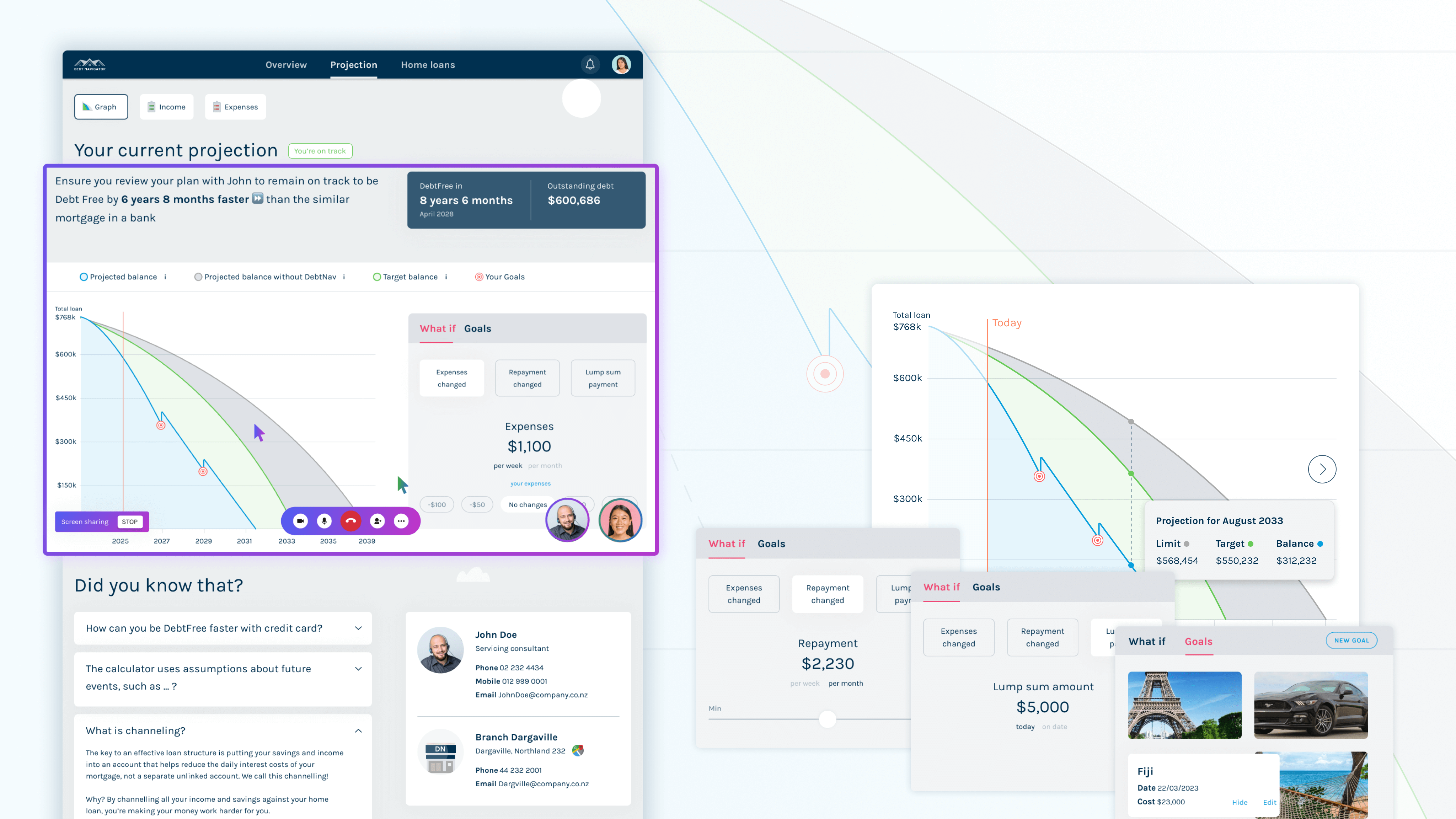

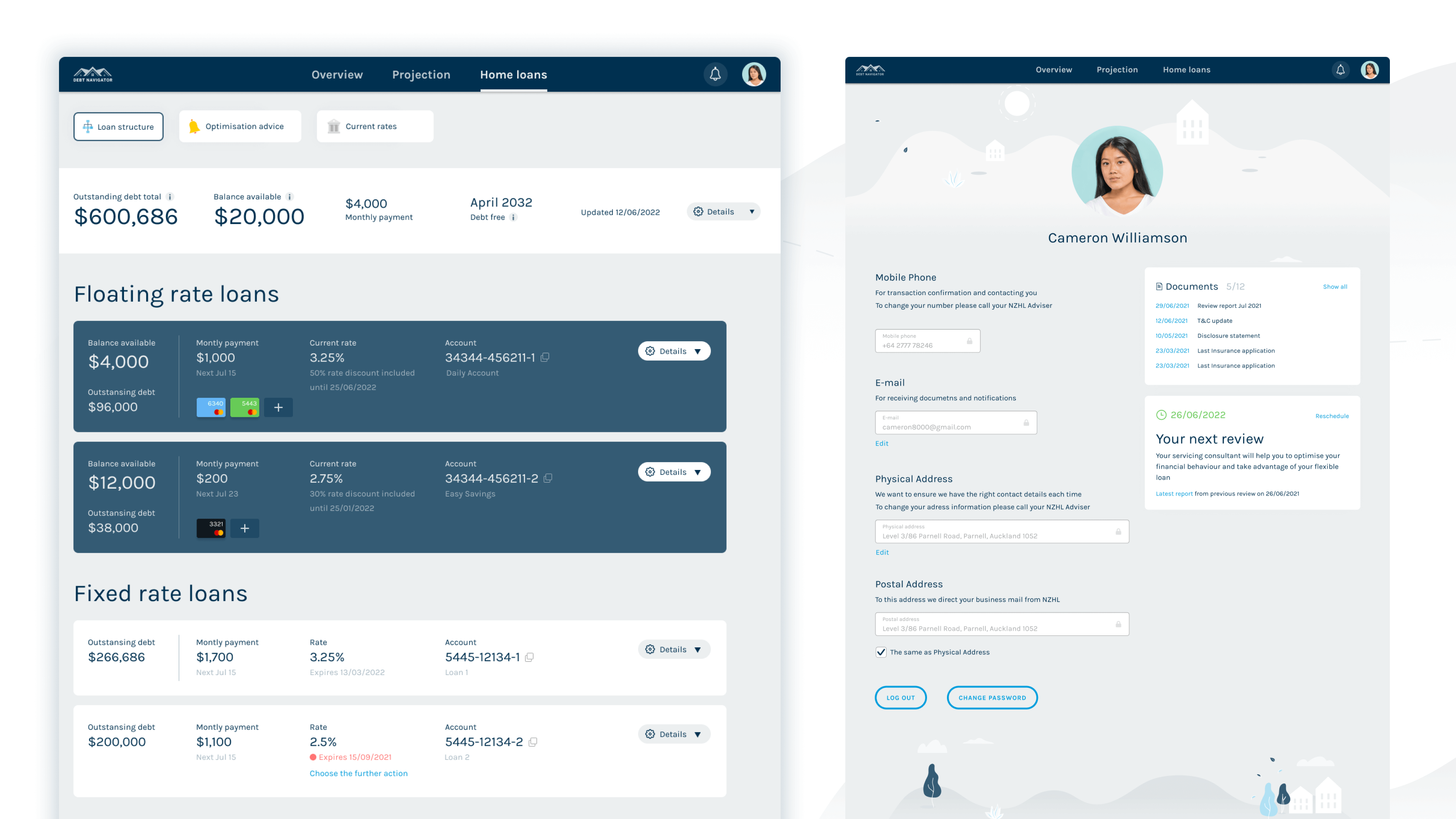

The project's goal was to upgrade the existing product and provide accurate and reliable data to clients at all stages of their customer experience.

RESULTS

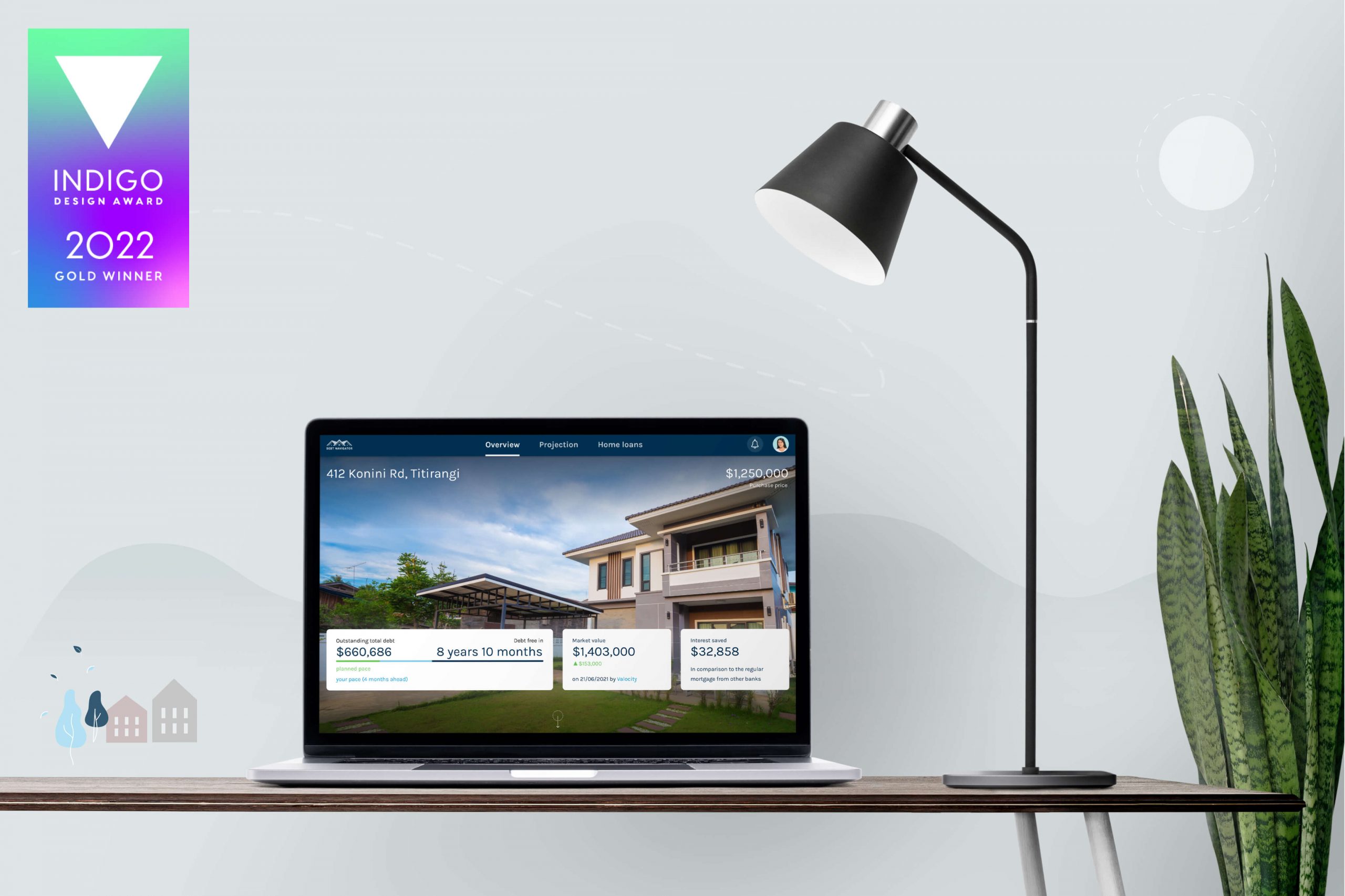

I redesigned the mortgage management platform, which resulted in:

- Mortgage advisors’ productivity increased by 17%.

- Avg task completion rate increased by 34%.

- Avg task time decreased by 36%.

The production-ready design has been handed over to a delivery partner.

2x Gold Award winner in the Indigo Design Awards for digital tools and interaction. Bronze winner for interface and navigation.

UNDERSTANDING THE USERS

During the discovery sessions, we revealed that there were multiple core users of the product:

- Mew business consultants, who primarily drive sales.

- Advisors, who lead the process and foster the continuity of care;

- First home buyers, who seek guidance in the purchasing process;

- Refinance seekers, who are the key segment for NZHL;

- Property investors.

These users would interact with the product differently, depending on their knowledge, mortgage lifetime, and personal goals.

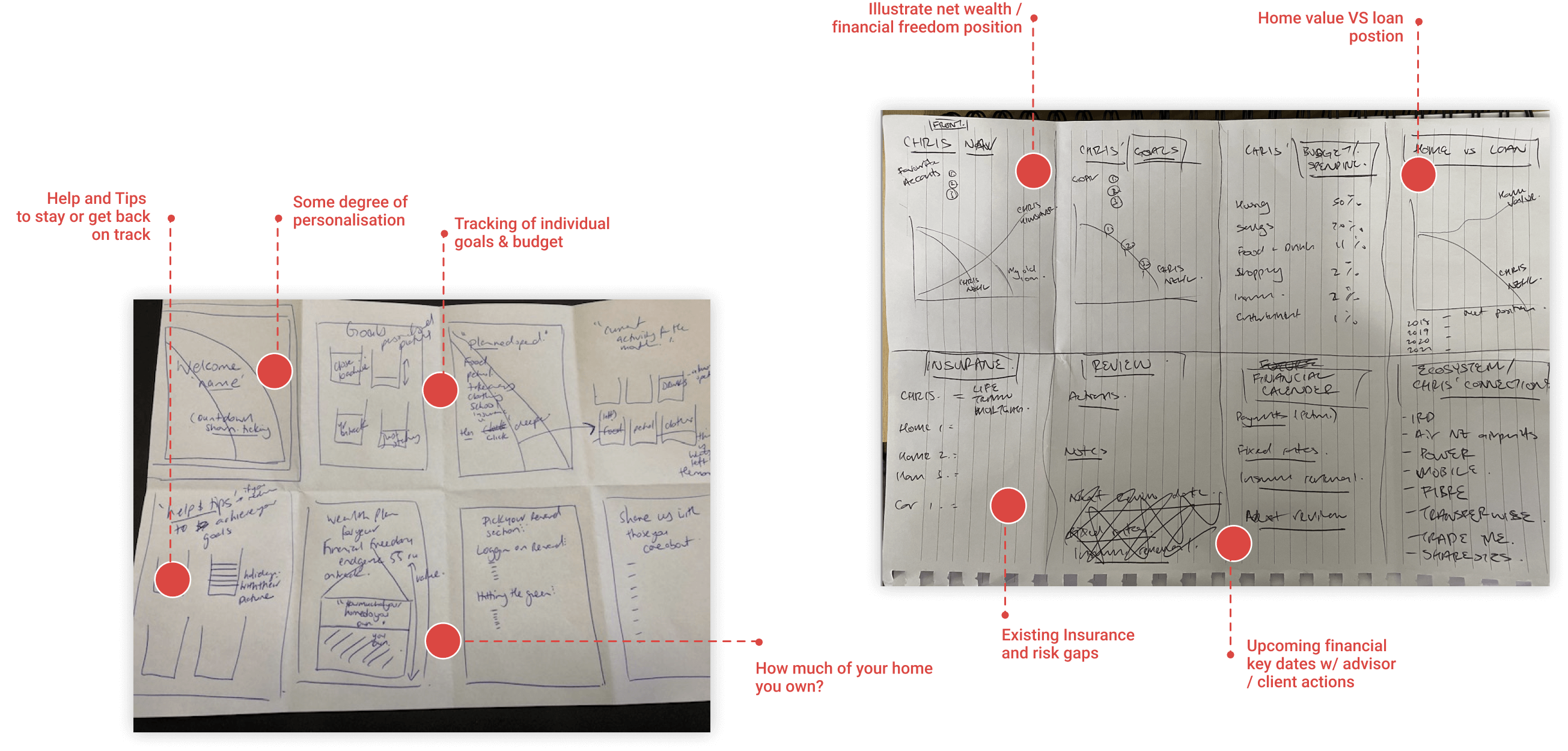

IDEATION AND CONCEPTS

Within the next couple of weeks, we shared initial concepts with key business owners and the initial set of end-users. We tweaked functionality based on research insights and technical limitations of the platform.

USABILITY TESTS

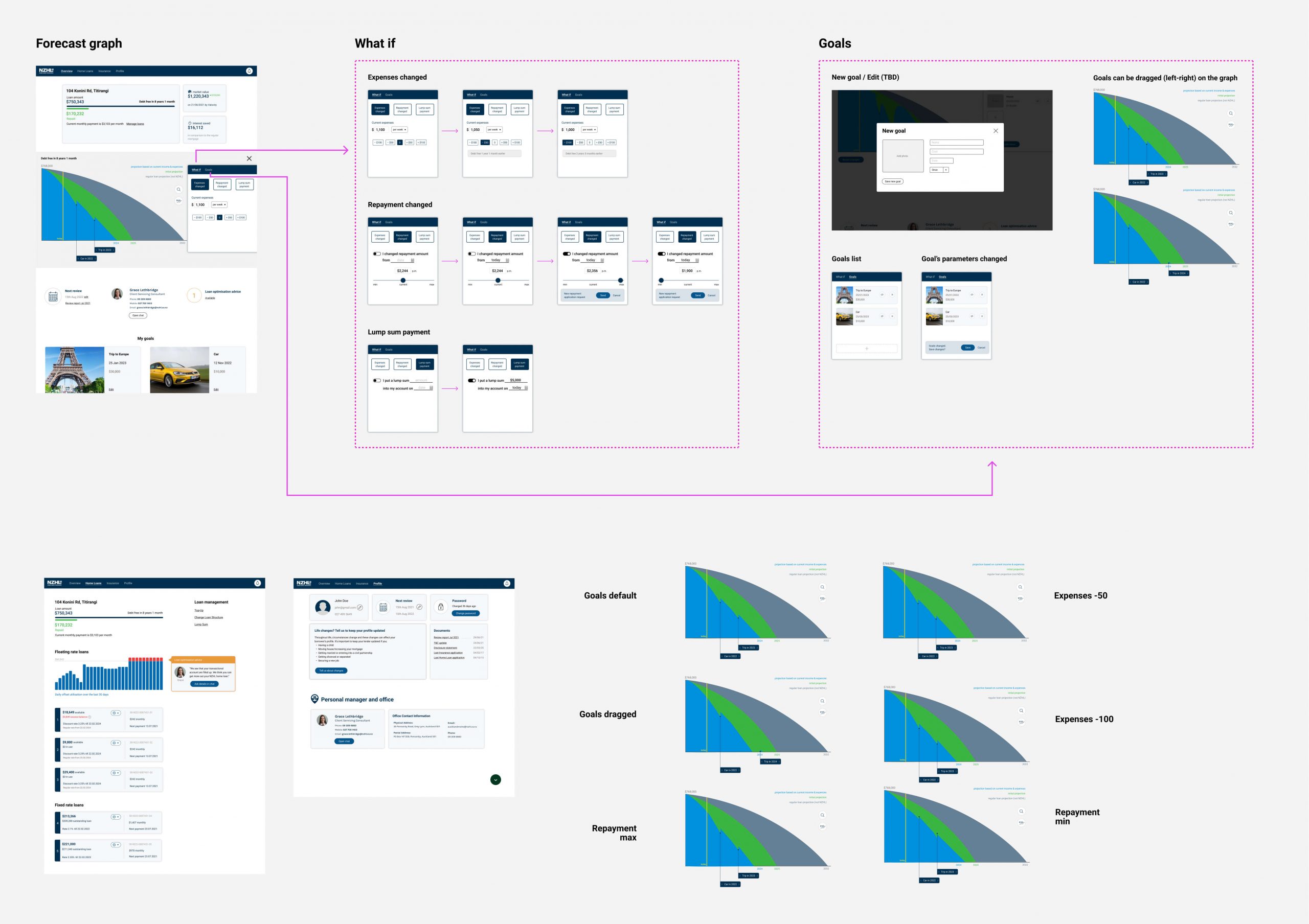

Once we had enough clarity on the structure and overall direction of the app, we conducted thorough user research with several groups, divided by segments, location and demography. We used simple prototypes in Figma to check the interface logic.

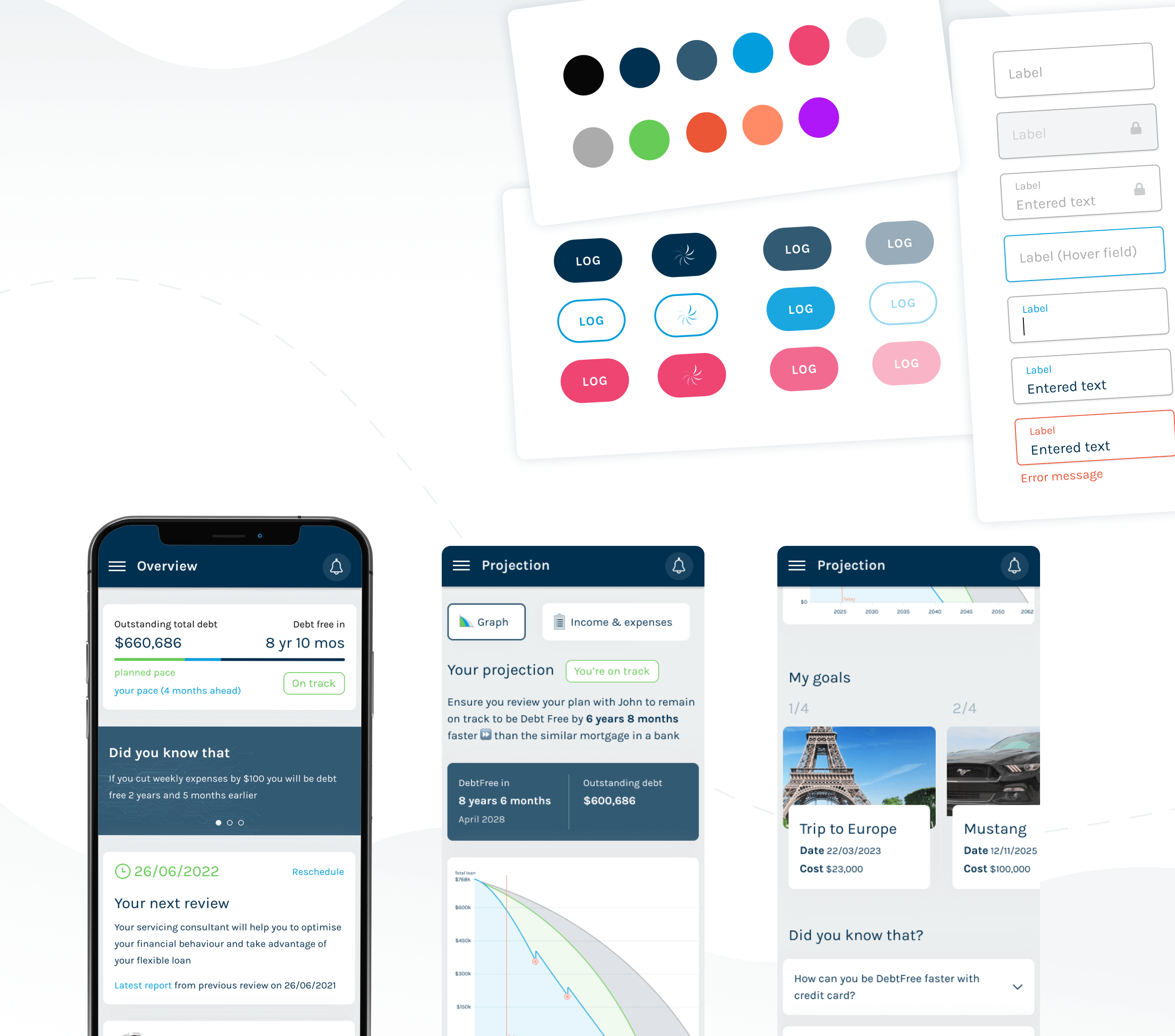

FINAL DESIGN

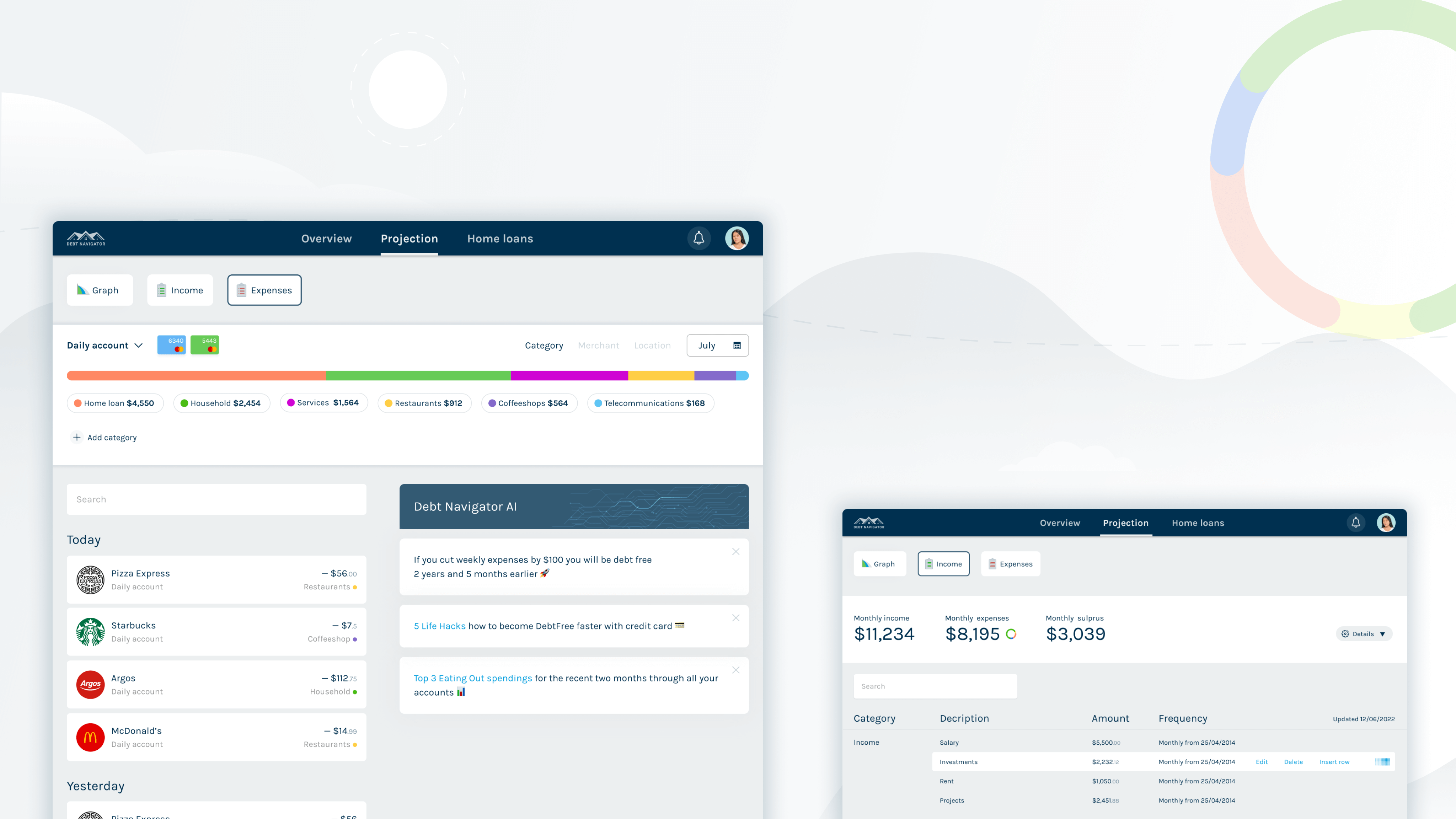

The product features include historical balance data and visualising loan structure to allow users to quickly see how they perform and get valuable insights from their daily habits. We've implemented daily transaction tracking based using OpenBanking APIs from major banks. With this data, advisors could create tailored advice with the possibility of automation in the future.

KEY CHALLENGES

The product has a deep legacy backend, and we realised that we couldn’t change some business processes to ease UX for customers. We had to save some scenarios as-is, but we could redesign them to get rid of existing UX problems not dependent on a backend logic.

This project has been completed remotely, including usability testing. I was in London, and the rest of the team was in New Zealand, 11hrs between us. The project was my weekend hustle, additionally we had sync meetings at evenings during the weekdays.

KEY TAKEAWAYS

Working in a large old-fashioned company requires great patience, understanding of the environment and strategy to achieve change.

I gained valuable experience working in a highly distanced team and reaffirmed that it’s possible to design end-to-end digital services fully remotely.

THANK YOU!